RISE OF DIGITAL OWNERSHIP

Collectors have long been willing to shell out huge sums of money on unique items such as fine art, classic cars, and antique books. Collectables are tangible assets which can be hung on a wall, stored in a garage, or displayed in a cabinet. Historically, the buying and selling of rare and desirable items has occurred at auction houses. Regardless, a new trend is emerging which enables investors to buy intangible, digital assets online.

Collectable items have moved into the virtual world using trendy new technology called non-fungible tokens (NFTs). An NFT (also called a crypto-collectable) is a one-of-a-kind asset which can be bought and sold like any piece of property even though it has no physical form of its own. Almost anything can be minted as an NFT including digital art, music videos, film clips, video games, luxury goods, and sports collectables such as football cards.

NFTs are changing how musicians and artists can earn a living. NFTs offer a way for “creators” of music and art to monetize their work via the sale of a token and get a slice (in the form of a royalty) of any resale value in the secondary market. Each token is unique, can’t be duplicated, and is basically a certificate of authenticity. While other people might have a copy of the artefact that you have purchased as an NFT, they don’t own the original item.

Think of Leonardo da Vinci’s painting, the Mona Lisa. It is the most famous portrait in the world and there are hundreds of thousands of reproductions of this masterpiece – but only one original. The same principle applies to NFTs – you can copy and paste an image, though only the original – digitally signed by the artist – holds value. Buying an NFT is like buying the original Mona Lisa, but instead of receiving an oil painting on wood, you get a JPG file.

Some people compare owning a crypto token to buying an autographed print. Each token contains computerised code that verifies it is the only asset with its specific digital identity. The tokens, as asset identifiers, are considered to be non-fungible since their uniqueness makes them irreplaceable and impossible to swap. As non-fungible tokens cannot be replicated, they are incapable of mutual substitution. An example will help here.

You and a friend are travelling together on a plane and have been issued with boarding passes. If the information on each pass was identical, they would be considered fungible – i.e., capable of being swapped for one another. However, each boarding pass contains unique information such as passenger name, seat number, and airline membership details. Consequently, they cannot be randomly exchanged with anyone else thereby making them non-fungible.

In contrast, a fungible asset is something that can be readily interchanged – like money. If I lend you $20, it doesn’t matter whether you pay me back with a different $20 banknote from the one that I gave you – any $20 bill will do. Equally, you can repay me with two $10 bills since the total equals $20. Items are considered fungible if exchanging them is meaningless, such as two people swapping $5 notes with each other.

Details of (non-fungible) digital tokens are recorded on an encrypted and publicly accessible ledger called a blockchain. Blockchain is the software architecture that underpins Bitcoin and other cryptocurrencies. Blockchain ledgers are not stored in one place but are distributed over thousands of computers around the world. These replicated ledgers are spread geographically across multiple sites, countries, and institutions.

Blockchains work by using a network of computers to create a shared digital ledger that no one computer can change. All computers must approve a transaction that has taken place before it is recorded in a “chain” of computer code. Every transaction is cryptographically chained to the previous transaction making blockchains perfect for creating unique digital identifiers which can be easily and securely exchanged — hence the creation of NFTs.

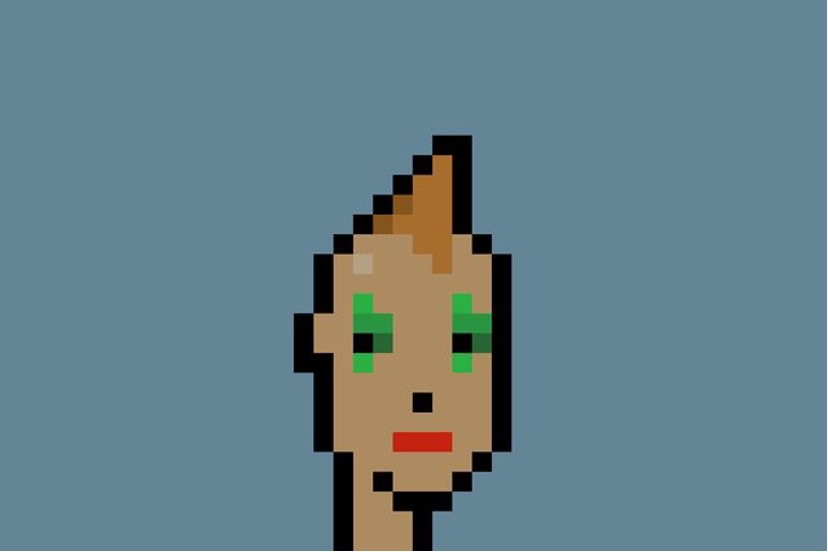

The idea of registering digital assets as NFTs on a blockchain began with CryptoPunks in June 2017. CryptoPunks are a set of unique collectable characters (10,000 to be precise) of randomly generated pixel-based avatars. However, NFTs did not come to prominence until October 2017 with the release of the blockchain based CryptoKitties game which enables players to buy and “breed” limited-edition virtual cats.

This past August, the global card payments processor, Visa, bought a CryptoPunk for nearly $150,000. Visa’s CryptoPunk is a pixelated digital image of a woman with a mohawk (see image below). Commenting on the purchase, Visa’s Head of Fintech, Terry Angelos, said: “We see an emerging new category of commerce that we’re calling NFT commerce”.

Cuy Sheffield, Head of Crypto at Visa, believes that NFTs will play an important role in the future of retail, social media, entertainment, and commerce. “To help our clients and partners participate, we need a first-hand understanding of the infrastructure requirements for a global brand to purchase, store, and leverage an NFT.”

Sheffield remarked that CryptoPunks have become a “cultural icon for the crypto community” and that Visa’s CryptoPunk purchase signalled that the company was “jumping in feet first”. He added: “This is just the beginning of our work in this space”.

According to online financial magazine, Barron’s, Bitcoin was predicted to take middlemen, like Visa, out of commerce entirely by allowing people to transact directly over the Internet, but that has not come to pass. That leaves an opening for incumbent players to maintain their importance. To quote Barron’s:

Visa sees an opportunity to be the rails for the new digital economy just as it has been the rails for the current one. It’s already connected to consumers and businesses, so people don’t need to use a completely new system. Visa’s interface with the public can be similar whether they pay through cryptocurrencies or dollars. The company already has helped crypto exchanges issue credit cards and other products.

Other companies to jump on the NFT bandwagon include Pizza Hut (pixelated pizza), Pringles (CryptoCrisp, the chips you can’t eat), Nike (Cryptokicks, limited edition sneakers), Vodaphone (augmented reality game), and McDonald’s (pixelated Big Mac). These brands have seized on NFTs as a way to engage with their audiences and promote their products. All want a seat at the NFT table because the crypto economy is expected to evolve rapidly.

Recently, the Australian Federal Government, along with the Reserve Bank of Australia, leading companies, and universities set up the Digital Finance Co-operative Research Centre (CRC). The CRC will undertake a decade-long research program examining the digitisation of real-world assets. The projected growth in this market is staggering, with tokenised assets expected to grow from almost nothing today to $US24 trillion ($A32 trillion) by 2027.

The government believes that the CRC’s work could add billions of dollars to Australia’s gross domestic product each year. The aim of the project is to unlock new assets and make them efficient to trade*. As reported in the Australian Financial Review, the CRC’s CEO predicts that the creation of digital versions of real-world assets “will have a profound impact on the rate of achievable economic growth and pave the way for new types of investable assets”.

As the craze of cryptocurrencies gains momentum, NFTs are emerging as a new investment option. New age collectors and investors are paying thousands and even millions of dollars to own digital collectables. Still, is this a bubble waiting to burst? Are NFTs highly speculative bets or do they offer value for money? The bottom line is that the NFT market is too immature to judge its long-term worth as an investment option.

So, it’s a case of buyer beware because the NFT market’s recent stratospheric rise is no guarantee of future returns. The harsh reality is that while some early investors have achieved insane windfalls, others will fork out inflated amounts for digital assets that may wind up being worthless. Another point to note is that the underlying technology is complicated for a layperson to understand, let alone use on their own.

Right now, NFTs are in the midst of a hype-cycle and trending upwards. Still, there is no assurance that demand for digital assets will continue at current levels. As with any new disruptive technology, there are pros and cons. So, take care to closely examine what could go wrong – the dark side of investing in NFTs is real, particularly as the value of art and other collectables is fundamentally subjective.

When it comes to NFTs, value (like beauty) lies in the eye of the beholder.

■ ■ ■

*To be clear, the work of the CRC is not focussed on digital assets like virtual cats. Rather, its mandate is to ensure that Australia is in a position to exploit the coming universal digitalisation of all real-world assets (such as gold, real estate, fine art, and carbon credits) so they can be traded and exchanged directly and in real-time between any individual or organisation.

Regards

Paul J. Thomas

Chief Executive Officer

Ductus Consulting

As you have explained, essentially NFTs are like physical collector’s items, only digital. Instead of getting an actual painting, the owner gets a digital file.

Keep in mind, an NFTs value is based entirely on what someone else is willing to pay for it. Therefore, demand will drive the price rather than economic indicators. Sentiment and avarice may drive NFTs price to ridiculous levels. I think if I was investing, I would invest small amounts of affordable money and take profit often.

Paul, great article. I am a fence sitter with digital assets however I can see the future will embrace them.

Blockchain has taken years to get out of the theorists heads, get funded and into practice. It really will revolutionise the financial industry globally!